Homeownership a Difference after a Year

Over the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them.

1. Move-up or Downsize: One option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit, especially if your lifestyle has changed this year.

2. Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying.

3. Refinance: If you already own a home, you may decide you’re going to refinance. It’s one way to lock in a lower monthly payment and save more over time. However, it also means paying upfront closing costs, too. If you want to take this route, you have to answer the question: Should I refinance my home?

Why 2020 Was a Great Year for Homeownership

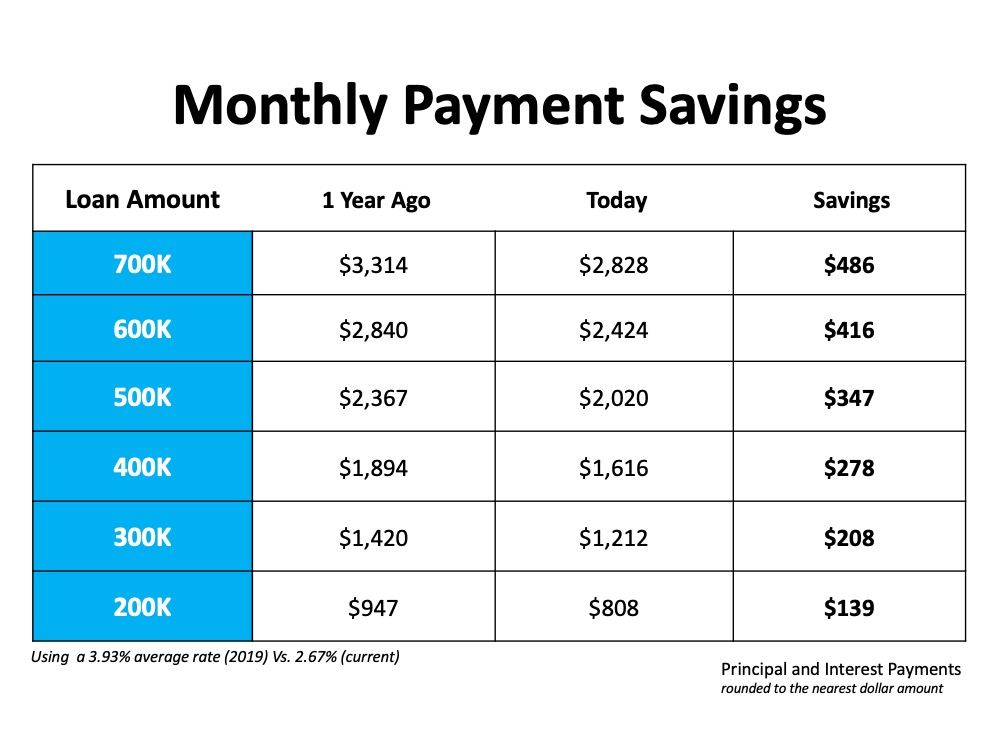

Last year, the average mortgage rate was 3.93% (substantially higher than it is today). If you waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The chart below shows how much you would save per month based on today’s rates compared to what you would have paid if you purchased a home exactly one year ago, depending on how much you finance:

Bottom Line

If you’ve been waiting since last year to make your move into homeownership or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Let’s connect today to discuss how you may benefit from the current rates.

The information contained, and the opinions expressed in this article are not intended to be construed as investment advice. Rafael Jarauta, Rafael Jarauta, PA or RealtyWonders.com, does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Rafael Jarauta, Rafael Jarauta, PA or RealtyWonders.com will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

La información contenida y opiniones expresadas en este artículo no tienen la intención de ser interpretadas como asesoramiento en materia de inversión. Rafael Jarauta, Rafael Jarauta PA o RealtyWonders.com no tienen ni garantías de la información o integridad de la información u opiniones aquí contenidas. Usted debe siempre realizar su propia investigación y su debida diligencia y obtener asesoramiento profesional antes de hacer o tomar una decisión de inversión. Rafael Jarauta, Rafael Jarauta PA o RealtyWonders.com no son ni seran responsables por ningun dano o perjuicio relacionado con la información u opiniones contenidas en este sitio web